Advertisements

Are you considering applying for a Victoria Secret credit card to enjoy exclusive benefits on your lingerie and beauty purchases? Let’s see if this card is worth its cost.

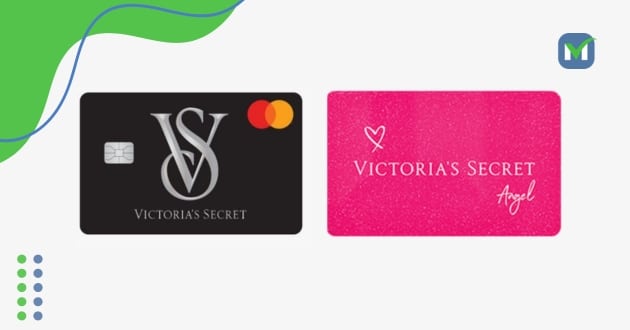

By analyzing the market, we realize that the Victoria Secret credit card is not just a card, but rather an ecosystem that includes closed-loop and open-loop versions, each with its specific features. We will look at all of them here.

Advertisements

In this article, you will learn all the vital information about the Victoria Secret credit card, from the application process to the fine print of the interest rates. We will analyze the official data on the points programs, the differences between the available cards, and what real consumer reviews say about the service. Let’s go!

Understanding theVictoria Secret Credit Cards

Victoria’s Secret, through its partnership with Comenity Bank, has structured its credit offering into two main categories. These categories confuse many consumers. Let’s look at the differences between the versions.

1. Victoria’s Secret Credit Card and PINK Credit Card

The closed-loop versions are the entry point for many customers. They are designed specifically for those who frequent the store regularly.

Advertisements

Both the Victoria-branded card and the PINK card have the same financial and reward features. As a rule, the focus here is internal consumption.

The issuing bank, Comenity Bank, generally evaluates the applicant’s credit history. Store cards tend to have slightly more flexible approval criteria than the Mastercard versions. They often offer low initial limits.

Its main attraction lies in direct integration with the brand’s loyalty program. This allows every dollar spent on store products to be converted into points quickly.

2. Victoria’s Secret Mastercard and PINK Mastercard

The Mastercard version elevates the financial product’s level by offering automatic Silver status immediately upon approval.

This puts the holder in an advantageous position within the rewards program from day one.

In addition to accumulating points on brand purchases, this card allows for accumulation on everyday external spending.

It is worth noting that the earning structure is designed to encourage the use of the card as a primary or secondary payment method in everyday life. It is not limited to use during visits to the mall.

However, this versatility is accompanied by interest rates (APR) that can be higher. This requires rigorous financial management by the holder to avoid debt.

The VS & PINK Rewards Program (Victoria Secret Credit Card)

The main attraction of theVictoria Secret credit card is its rewards program, VS & PINK Rewards.

As a rule, this system is stratified into levels — Member, Silver, and Gold. Owning the credit card is a direct shortcut to the higher levels.

For cardholders, point accumulation is faster than for regular loyalty program members.

On this card, the base structure offers points per dollar spent, which vary according to the customer’s level and the type of product purchased.

A relevant feature is the bonus for purchasing bras. In this case, the consumer receives triple points. This dramatically accelerates the earning of financial rewards for future in-store use.

The redemption mechanic is simple: for every 2,000 points accumulated, the system generates a 10 dollar reward.

For a Silver level cardholder, who earns 10 points per dollar, or a Gold level, who earns 15 points per dollar, the return on spending is tangible.

In addition to points, the program offers logistical and commemorative benefits.

Furthermore, free shipping is a tiered benefit, available for orders over 50 dollars for Silver members and over 25 dollars for Gold members.

Point Acceleration with Mastercard

For those who have the Mastercard version, the points math expands outside the brand’s stores.

The program encourages the use of the card in specific high-consumption categories. It is worth noting that spending on restaurants, travel, and streaming services generates 4 points per dollar, a competitive rate for a card with no annual fee.

Other general purchases yield 2 points per dollar. There is also an aggressive initial incentive: a 30 dollar bonus is granted if the holder spends 500 dollars outside the brand in the first 90 days after opening the account.

Costs, Fees, and Interest on Victoria Secret Credit Cards

Although the absence of an annual fee is a strong point of the Victoria Secret credit card, the cost of credit is a factor that requires extra attention.

Interest rates, known as APR (Annual Percentage Rate), are notoriously high for this type of product.

As a rule, the closed-loop version of the card charges an interest rate of around 25.99% on purchases, which can significantly increase the total cost if the cardholder does not pay the full balance by the due date.

The Mastercard version has variable rates that can exceed 30%, with studies indicating store rates reaching 35.99%.

In addition to revolving interest, there are severe penalties for non-compliance with payment obligations.

It is worth noting that the card charges a late fee of up to $41, and it applies the same amount in cases of returned payments.

The invoice usually expires 25 days after the closing of the cycle.

For the Mastercard version, which can be used internationally, fees may also apply to transactions abroad, which must be checked in the updated contract, as it is a common charge for cards in this category.

Conclusion (Victoria Secret Credit Card)

The Victoria Secret credit card presents itself as a robust loyalty tool for the brand’s regular consumer, offering an accelerated path to rewards and benefits such as free shipping.

It is worth mentioning that the absence of an annual fee is a strong initial attraction. However, the high interest rates and late penalties demand impeccable financial discipline.

The choice between the store version and the Mastercard should be based purely on the intention of use and the user’s credit management capacity.

If you have decided that the benefits outweigh the risks, the next step is to access the official website or visit a store to formalize your application.

Read the current terms carefully, plan your payments to avoid interest, and use the card strategically to extract the maximum from the rewards program without falling into the traps of revolving credit.

Do you want a card that offers discounts on more products, allowing you to earn cashback on all purchases? Then, we recommend you check out the Best Buy credit card activation.