Advertisements

The Citi Double Cash Card offers an appealing cash back reward program which makes it a coveted choice for many. In this article, we’ll guide you through the process of how to apply for the Citi Double Cash Card, discussing eligibility requirements, the application process, and what to do after your application is submitted.

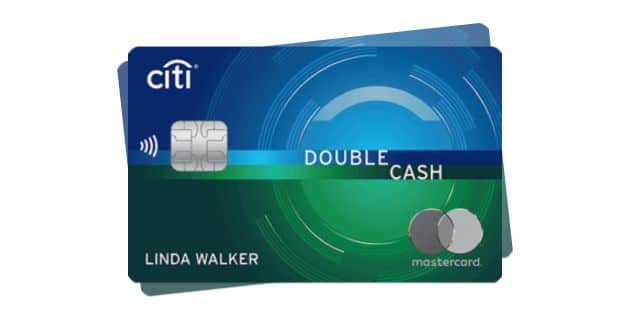

Understanding the Citi Double Cash Card

The Citi Double Cash Card is well-known for its simplicity and efficiency in rewards. Cardholders can earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. It is important to consider how these benefits align with your spending habits and financial goals before applying.

Eligibility Requirements

Before diving into the application process, you must meet certain eligibility criteria:

- Age: You must be at least 18 years old.

- Residency: Applicants must be U.S. residents.

- Credit Score: A good to excellent credit score (typically 700 or above) is required.

- Financial Information: You will need to provide personal and financial information, which may include your annual income and monthly mortgage or rent payment.

Preparing to Apply

To streamline your application process, gather all necessary documents and information in advance:

- Social Security Number (SSN)

- Annual income and employment information

- Monthly housing payment

- A list of your current financial obligations

The Application Process

Step-by-Step Guide

- Visit the Official Website: Start by visiting Citi’s official website. Navigate to the credit card section and select the Citi Double Cash Card.

- Fill Out the Application Form: Enter all required information in the designated fields. Ensure that all details are accurate to avoid delays in processing.

- Review Your Information: Double-check your application for any errors or omissions.

- Submit the Application: Once you’ve reviewed everything, submit your application online.

Table: Application Checklist

| Item | Description | Completed |

|---|---|---|

| Personal Information | Full name, address, SSN, date of birth | [ ] |

| Financial Information | Annual income, employment details | [ ] |

| Review | Double-check entries for accuracy | [ ] |

| Submission | Submit the application online | [ ] |

After Submitting Your Application

What to Expect

- Approval Time: The approval process may take a few minutes to a few weeks. Some applications may require further review or additional information.

- Receiving Your Card: If approved, you will receive your card and welcome materials in the mail within 7-10 business days.

If You Are Not Approved

If your application is not approved, Citi will provide an explanation and the main reasons for the decision. This can be a good opportunity to review your credit report and address any issues.

Advertisements

Frequently Asked Questions

1 – Can I apply for the card with a co-applicant?

- No, the Citi Double Cash Card does not allow co-applicants at this time.

2 – What can I do if my application is denied?

- You can request a copy of the credit report used in the decision, review it for accuracy, and address any discrepancies.

3 – How does the 2% cash back work?

- You earn 1% cash back when you make a purchase and another 1% when you pay off that purchase.

By following these detailed steps and preparing accordingly, you can enhance your chances of getting approved for the Citi Double Cash Card.

This card could be a great asset in managing your finances effectively while earning rewards on your purchases.

You will go to the official card website!

Advertisements