Advertisements

Undertaking a student loans UK application is, without a doubt, the most critical initial step for any student planning to enter British higher education in the academic cycle.

Many applicants, whether residents or international students, face difficulties when starting their student loans UK application due to the complexity of the eligibility rules that distinguish public from private funds.

Advertisements

In this article, we will examine each stage of the student loans UK application, offering an exact roadmap based on the most recent regulations from the Student Loans Company and private lenders. Read on.

Main Student Finance England Programs

1. Tuition Fee Loan (Student loans UK application)

This is the central pillar of access to higher education for residents, offered directly by the UK Government.

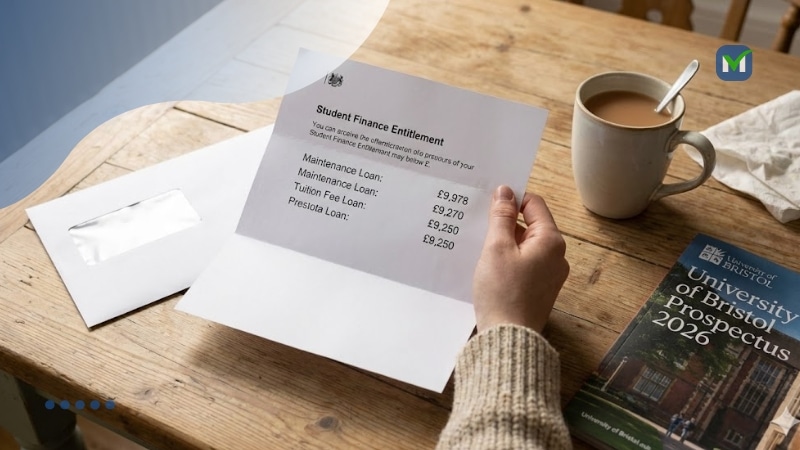

As a rule, the Tuition Fee Loan fully covers the cost of tuition, with a ceiling set at £9,250 for full-time courses at public universities.

Advertisements

For accelerated courses, which compress three years of content into two, the limit rises to £11,100. An important operational feature of this loan is that the capital never passes through the student’s bank account.

As a rule, the Treasury transfers the amounts directly to the Higher Education Institution in three strategic installments: 25% in the first term, 25% in the second, and the remaining 50% in the third.

This ensures that the university receives its funds but also prevents the student from using this money for other purposes.

2. Maintenance Loan

Unlike tuition fee financing, the Maintenance Loan is deposited directly into the student’s account and is intended to cover living costs such as rent, food, and transport.

In this case, the structure of this product is progressive and heavily based on family income (Household Income).

It works like this: the system calculates an “Expected Family Contribution”; the higher the income of the parents or partners, the lower the government subsidy, based on the premise that the family will cover the difference.

The amount also fluctuates geographically.

Students living at their parents’ home receive the lowest base amount. Those studying away from home, but outside London, receive an intermediate amount.

Those studying in London have access to the maximum ceiling, reflecting the capital’s premium cost of living, which can reach around £13,348 annually.

3. Financing for Postgraduate Studies (Student loans UK application)

For the Master’s level, the government offers a single contribution loan of up to £12,858.

This amount is paid directly to the student, who has total autonomy—and responsibility—over its allocation.

If the cost of your Master’s is high, you might need to use the entirety of this amount just to pay the university, leaving zero for living costs.

For Doctorate (PhD) studies, the support is more robust, with a cumulative amount of up to £30,301 for the entire duration of the course, designed to support long-term research.

Private and International Alternatives for Student Financing

When public funds are insufficient or inaccessible, the private market and international agreements become the necessary route.

1. US Federal Student Aid (Title IV)

American citizens have a unique strategic advantage. Through the William D. Ford Federal Direct Loan program, it is possible to apply US federal funds to study in the United Kingdom.

The process involves two main types of loan: the “Direct Loans” (subsidized and unsubsidized) and the “PLUS Loans”.

You need to know that PLUS loans are particularly powerful because they can cover the total gap up to the “Cost of Attendance” (COA), which includes not only tuition but also international travel, visa, and living costs.

2. Fintechs and Borderless Loans (Student loans UK application)

Financial innovation has brought players like Prodigy Finance and Lendwise into the spotlight.

Prodigy operates with a disruptive model that assesses risk based on the student’s “Future Earnings Potential,” dispensing with the need for co-signers or physical collateral, which is vital for international students from emerging markets.

However, it is restricted to high-return courses (MBA, Engineering, Law) at elite universities.

Lendwise, in turn, focuses on postgraduate studies and uses traditional credit checks, offering fixed rates that protect the student from market volatility but requiring a clean financial history.

Step-by-Step for the UK Student Loans Application

Bureaucracy does not forgive delays. Below, we detail the workflow to ensure the money arrives on time.

Guide for Government Applications (SFE)

The process should begin in the spring prior to the start of the course, ideally in March.

- Digital Identity: Create your account on the government portal. Have your British passport or birth certificate in hand. The system validates your identity digitally with the HM Passport Office.

- Parental Details: If you are under 25, your parents will receive a separate link to declare the income from the previous tax year. They should not provide this data through your student account for data security reasons.

- PN1 Form: Complete the application indicating your first-choice university. Tip! Always request the maximum amount available for the “Maintenance Loan”; it is easy to reduce the amount later, but bureaucratic to increase it.

- Enrollment and Payment: After receiving the notification letter, you must complete in-person registration at the university in September. The institution sends an electronic code to the SLC, and the money falls into the account within 3 to 5 business days.

International Route (FAFSA/USA)

The process for Americans is manual and requires proactivity.

- FAFSA: Complete the federal form using the specific code of the British university (e.g., G09085 for York).

- Active Notification: UK universities do not automatically download your data. Therefore, you must send an email to the financial aid department informing them that you have submitted the FAFSA.

- COA Calculation: The university will send a spreadsheet with the Cost of Attendance. You need to indicate how much you wish to borrow within that limit.

- Visa Letter: After approval, the university issues a loan letter. This document is mandatory for the Student Visa application, serving as the proof of funds required by immigration.

UK Student Loans Comparison

| Loan Option | Target Audience | Estimated Rate (2025) | Financing Ceiling |

| SFE Tuition Fee Loan | UK Residents | 3.2% (RPI Indexed) | £9,250 (100% Fees) |

| SFE Maintenance Loan | UK Residents | 3.2% (RPI Indexed) | ~£13,348 (London) |

| SFE Master’s Loan | UK Postgraduates | 6.2% | £12,858 (Fixed) |

| SFE Doctoral Loan | UK PhD | 6.2% | £30,301 (Total) |

| Direct Unsubsidized | US Citizens | ~6.53% | $20,500/year |

| Direct PLUS Loan | USA (Parents/Postgrad) | ~8.08% | Up to Total COA |

| Prodigy Finance | International | Var. (SOFR + 7-10%) | Up to COA |

| Lendwise | Postgrad (All Nats.) | Fixed (9-12% APR) | Up to £100,000 |

| Sallie Mae | US Citizens | Variable or Fixed | 100% Certified |

| StepEx (ISA) | Tech Areas | % of Future Salary | Variable |

Conclusion

The academic cycle solidifies a trend of greater individual responsibility in financing higher education in the United Kingdom.

The implementation of Plan 5 and the diversification of private options require the student to act not just as an academic, but as a manager of their own future assets.

It is emphasized that the choice between public and private financing, or a combination of both, will define your financial flexibility for the next four decades.

While the public system offers protection against insolvency, private options guarantee access to elite institutions and cover costs that the state ignores.

Do not leave it until the last minute. Check your eligibility, organize your income documents, and start your UK student loans application today to ensure your focus remains where it should be: on your education and your professional future.

In addition to this credit, would you like extra credit to settle into the city, without complications? Then, it is also worth applying for a personal loans bad credit UK.